LECTURE 8 | C.F.O

COMPETITION. FUNDRAISING. OUTRO

COMPETITION

Rule # 1 in competition is Don’t Do It!

Never go up against market forces; find a small group of particular people concentrated together and served by FEW or NO competitors. Competitive markets aren’t where the big profits can be found; it’s better to create new markets. Get the hobbyists instead; start small and monopolize. Only once you have found your niche, scale up. But don’t intentionally set out to be disruptive.

Competitors are a startup ghost story. First-time founders think they are what kill 99% of startups. But 99% of startups die from suicide, not murder.

Worry instead about all of your internal problems. If you fail, it will very likely be because you failed to make a great product and/or failed to make a great company.

99% of the time, you should ignore competitors. Especially ignore them when they raise a lot of money or make a lot of noise in the press. Do not worry about a competitor until they are beating you with a real, shipped product. Press releases are easier to write than code, which is easier still than making a great product. In the words of Henry Ford: "The competitor to be feared is one who never bothers about you at all, but goes on making his own business better all the time."

Every giant company has faced worse competitive threats than what you are facing now when they were small, and they all came out ok. There is always a counter-move.

Now, we live in a culture where it’s hard to get people to buy into products that are complicated or hard to build. Having a fast adoption is critical to taking and capturing markets. A small market with a slow adoption rate can lead to other companies competing with you, while a small to mid-sized market with a fast adoption rate are the ones that you can attempt to take over.

How can you build a Monopoly?

Proprietary technology

Network effects

Economies of scaling

Branding

In the beginning, you’ll want to go after smaller markets as they’re easier to dominate than larger ones. By starting small, you’ll have the advantage to take over a whole market and expand. Having a unique business also gives you the upper-hand as the products offered may be things that haven’t been done yet. Almost all successful companies in the Silicon Valley started with a model of starting a small business and expanding (i.e. Amazon was an online bookstore, then expanded).

Most of the value of these companies come from growth rate. Established firms in established markets have competition; their margins are chipped away by market forces. Startups in innovative markets are more likely to have monopolies; their good days are still ahead of them.

The rule of thumb in tech is to create something that’s an order of magnitude better than the next big thing. For software, you have to create something better than what already exists.

Proprietary technology is tricky, as areas of innovative tech can be at risk of being surpassed by someone else. In those situations, you can make a lot of innovation but because people are constantly building better programs, your product can be replaced. This can be great for customers as products are constantly getting better, but it won’t help those that start the company. Instead, you’ll want to focus on what will make your company the leading one in 10-15 years from now.

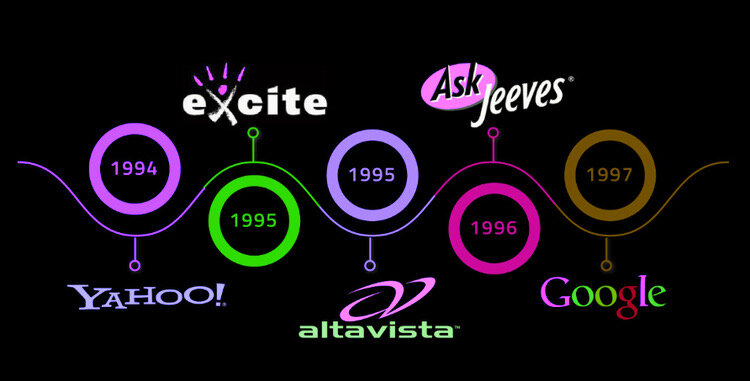

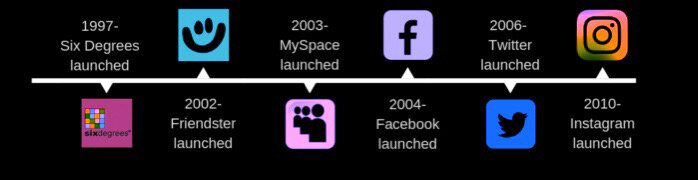

First Mover versus Late Mover Advantage? Should I be the first mover and pick up as much market share as possible or be the last mover; make the last great development in a specific market and enjoy decades of monopoly profits. Sometimes it’s better to have the last significant boom and ride it longer; it’s much easier to improve on somebody else's idea than it is to build something from scratch. Facebook came way after Myspace and Friendster and before there was Google there was Yahoo and the seven dwarfs; just Ask Jeeves!

But you can also go first, leave your foot on the gas, build a big lead and gobble up the market and ring the exchange bell like Uber and Lyft. By being the first-mover in the smartphone and tablet markets, Apple saw its shares quantify in value. So is it better to go first or last? My answer is both and that it doesn't matter if you stop innovating.

What is the psychology of competition?

There’s something in nature about mimicking which is why we tend to find it reassuring if other people are doing what we’re doing.

COPY OF A COPY

OF A COPY OF A

COPY OF A COPY

COPY OF A COPY

OF A COPY OF A

COPY OF A COPY

However, competition isn’t a form of validation. It’s a blind spot psychologically as well as intellectually, as it gets people wrapped up in the idea of winning rather than being better. This can make people forget what’s truly important and valuable.

FUNDRAISING

VC | VENTURE CAPITAL

VENTURE CAPITAL

A GAME OF OUTLIERS

Venture capital business is a game of outliers. The statistics are in four thousand venture fundable companies that want to raise venture capital about 200 will get funded by a top tier VC and about 15 of the 200 will someday get to a hundred million dollars in revenue. Venture capital is an extreme business, you’re either in or not.

OUTSIDE THE NUMBERS

4000 need funding

200 get funding

15 will generate $100 Million in revenue

Top tier venture capitalists generally only invest in two kinds of companies:

(1) if they have previously raised a seed round

and

(2) once in a while will go straight to a company that hasn’t raised a seed round only when it’s a founder they have worked with in the past.

Smart VCs invest in strength versus lack of weakness. Companies that have really extreme strengths often have serious flaws. Companies that have a good founder, idea, products, and initial customers may not always have something that makes them really remarkable and special that makes them a big winner.

VC’s invest in companies that have product market fit, A strong founding team with a ton of talent who know how to mitigate risk, and a scalable business that has potential to get to $1B market. So try to work on achieving those things as opposed to working on a pitch deck. Because when it’s all said and done you won’t be able to fool the investors you need to become successful. And getting those investors ultimately comes down to who you know, not what you know. It’s beginning to change, but most investors unfortunately still require introductions from people you both know to take you seriously. You’re either in the Boys Club or you’re not; it’s A World Of Who Knows Who, Introductions And Handshakes (and Patagonia Fleece). So you are always better off making your business better than making your pitch better.

The secret to successfully raising money is to have a good company. All of the other stuff founders do to try to over-optimize the process probably only matters about 5% of the time. Investors are looking for companies that are going to be really successful whether or not they invest, but that can grow faster with outside capital. The “really successful” part is important—because investors’ returns are dominated by the big successes. If an investor believes you have a 100% chance of creating a $10 million company but almost no chance of building a larger company, he/she will still probably not invest even at a very low valuation. Always explain why you could be a huge success.

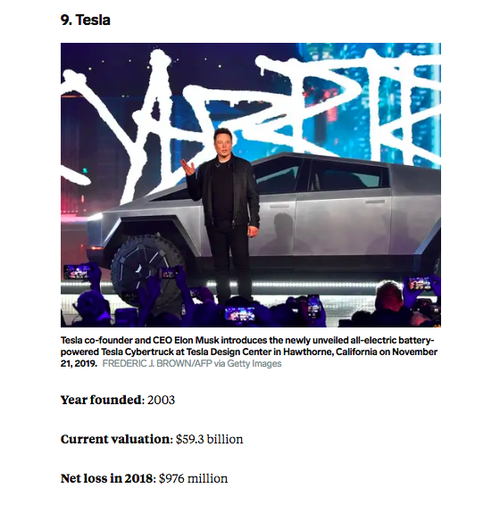

There are some startup companies that don’t make much money, yet they are valued higher than established companies with good cash flows. This seems illogical on its face, but an important part of the value of a company is how much potential it has for profit in the future.

HERE ARE 9 (UNPROFITABLE) BILLION DOLLAR STARTUPS

Investors are driven by the dual fears of missing the next Google, and fear of losing money on something that in retrospect looks obviously stupid. (For the best companies, they fear both at the same time.)

TIP: You should Bootstrap (be a business that does not require investors) for as long as you can. The key to success is to be so good they can’t ignore you. Build a business that is going to be a gigantic success. If you come with a theory and plan but no data, you are just one of the next thousand and it will be harder to raise money.

Raising money is a full-time job. But it’s not a job where you raise the most. Or give away too much equity; it gets tricky. The more capital your business is going to need, you need to be more precise on which are the milestones you need to achieve. The risk is higher so you need to be very precise on what you are going to accomplish with your A round. If you end up raising too much money in the A round that is going to screw you over in the next rounds. The cumulative dilutions will be too much so you have to be precise about which milestones you’ll achieve in each round.

The single biggest thing entrepreneurs are missing both on fundraising and how they run their companies is the relationship between risk and cash.

Onion Theory of Risk

Raise Capital to Peel away layers of Risk as you Go!

Andy Rachleff onion theory of risk says basically that you can think about a startup one day as having every conceivable kind of risk and you can basically make a list of the risks:

Founding Team Risks - are founders going to be able to work together?

Product Risk - can you build the product?

Technical Risk - are you going to have something that works, or are you going to be able to do it?

Launch Risk - did the launch go well?

Market Acceptance Risk

Revenue Risk

Sales Risk, can you actually sell enough to pay for the cost of sales?

if you are a consumer product, you have viral Growth Risk

And there’s a ton more types of risk that are company/product/industry specific you can Just Fill In The Blank ________ Risks

You raise seed money in order to peel away risks, basically peeling away risks as you go.

Survive and Advance - It’s like March Madness all the time, a thousand things can and will happen.

As you achieve milestones, you are making progress and justifying more capital. The best way to pitch to someone is to say which milestones you achieved and which risks you eliminated. Pitching this way is more systematic than raising as much money as possible, building offices, hiring, and hoping for the best after.

Get the money you need, not more than that.

Most startups raise money at some point. But money costs money; it’s expensive so you should get something in return for it. You should raise capital from someone who has domain expertise in your company; someone who can definitely help you with introductions for business development or for series A.

It’s a bad idea to try to raise money when your company isn’t in good enough shape to attract capital. You will burn your reputation and waste time.

You should raise money when you need it or when it’s available on good terms.

Remember that your time is money; be prepared. Give investors the gist of what you’re trying to sell by preparing a one-page executive summary for a brief overview. If the investors don’t know what you’re trying to sell through a simple explanation, neither will customers.

Investors don’t want to know about what your product could do. They want to know what it can do. Before trying to pitch the product, try releasing early prototypes of the product to gain an audience of interested users. You will want to be able to showcase your ability to create, manage, and fulfill demand. Be prepared to answer questions. If an investor is interested in your product, chances are, they’ll have questions for you. Being able to answer any questions thrown at you will demonstrate your ability to think on your feet and as well as your form of persuasion.

Don’t get demoralized if you struggle to raise money. Many of the best companies have struggled with this, because the best companies so often look bad at the beginning (and they nearly always look unfashionable.) When investors tell you no, believe the no but not the reason. And remember that anything but “yes” is a “no”—investors have a wonderful ability to say “no” in a way that sounds like “maybe yes”.

It’s really important to have fundraising conversations in parallel—don’t go down a list of your favorite investors sequentially. The way to get investors to act is fear of other investors taking away their opportunity. Most investors, due to their unusually high level of Competitiveness, Drive and/or Greed, have major FOMO (Fear Of Missing Out) syndrome.

FOMO | Investors act on the Fear Of Missing Out

You should view fundraising as a necessary evil and something to get done as quickly as possible. Some founders fall in love with fundraising; this is always bad. It’s best to have just one founder do it so the company doesn’t grind to a halt.

Remember that most VCs don’t know much about most industries. Metrics are always the most convincing.

Insist on clean terms (complicated terms compound and get worse each round) but don’t over-optimize, especially on valuation. Valuation is something quantitative to compete on, and so founders love to compete for the highest valuation. But intermediate valuations don’t matter much.

The first check is the hardest to get, so focus your energies on getting that, which usually means focusing your attention on whoever loves you the most. Always have multiple plans, one of which is not raising anything, and be flexible depending on interest—if you can put more money to good use, and it’s available on reasonable terms, be open to taking it.

An important key to being good at pitching is to make your story as clear and easy to understand as possible. Of course, the most important key is to actually have a good company. There are lots of thoughts about what to include in a pitch, but at a minimum you need to have: mission, problem, product/service, business model, team, market and market growth rate, and financials. And the only predictions that should be used in a pitch are the three versions of your company’s financial projections which should include:

Best case

Moderate Case

Worst Case

A great example is slide # 20 of Uber’s 2008 Pitchdeck; back then they had ten cars and the company was called UberCab.

Remember that the bar for each round of funding is much higher. If you got away with just being a compelling presenter for your seed round, don’t be surprised when it doesn’t work for your Series A.

Good investors really do add a lot of value. Bad investors detract a lot. Most investors fall in the middle and neither add nor detract. Investors that only invest a small amount usually don’t do anything for you (i.e., beware party rounds).

Great board members are one of the best outside forcing functions for a company other than users, and outside forcing functions are worth more than most founders think. Be willing to accept a lower valuation to get a great board member who is willing to be very involved. And try to keep in mind that diversity on your board is actually a huge advantage.

TIP: Be careful not to lose your sense of frugality or to start solving problems by throwing money at them. Not having enough money can be bad, but having too much money is almost always bad.

Yeah, don’t do this.

One last thing, Raising money is not actually a success or milestone. Raising venture capital is the easiest thing a startup founder is ever going to do compared to recruiting engineers, selling to large enterprises, getting viral growth, getting advertising revenue. There are seven milestones that every startup must focus on.

7 STARTUP MILESTONES

Prove your concept

Complete your design specifications

Create a prototype

Finance your business

Ship a beta

Ship the real thing

Achieve break-even

If you miss any of them, it’ll probably be Game Over for you.

Startups are tough, the X factor is something you can’t buy with money. Not even with 2 billion dollars. Sometimes not even all the connections and resources in the world matter.

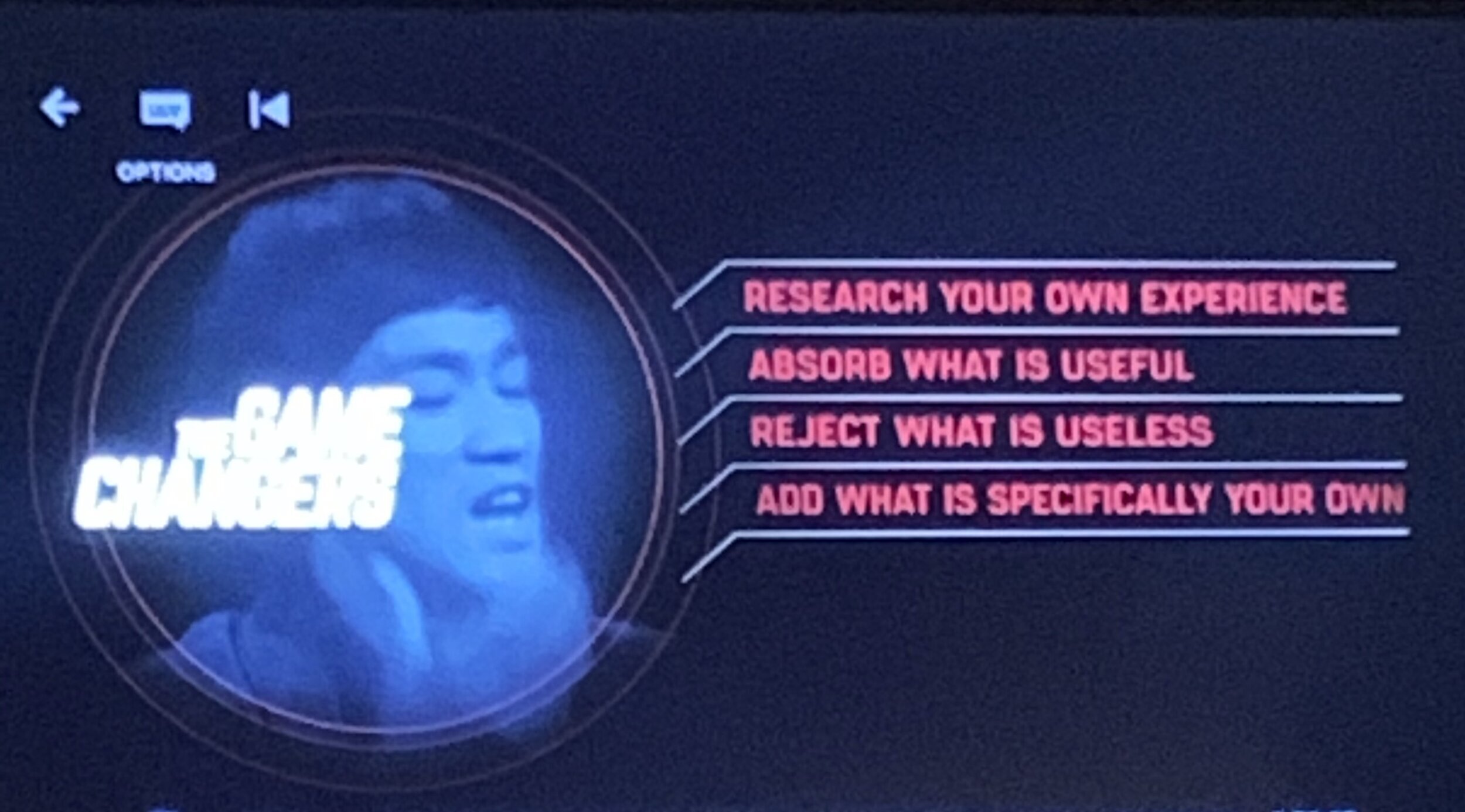

OUTRO

It shouldn't be that surprising that colleges can't teach students how to be good startup founders, because they can't teach them how to be good employees either.

The way universities "teach" students how to be employees is to hand off the task to companies via internship programs.

But you couldn't do the equivalent thing for startups, because by definition if the students did well they would never come back. (Duh)

If your goal is to start a startup, you can stick even more closely to the ideal of a liberal education than past generations have. Back when students focused mainly on getting a job after college, they thought at least a little about how the courses they took might look to an employer. And perhaps even worse, they might shy away from taking a difficult class lest they get a low grade, which would harm their all-important GPA. The good news is users don't care what your GPA was. And I've never heard of investors caring either.

What you need to learn about are the needs of your own users, and you can't do that until you actually start the company. So starting a startup is intrinsically something you can only really learn by doing it. And it's impossible to do that in college because startups take over your life.

The optimal thing to do in college if you want to be a successful startup founder is not some sort of new, vocational version of college focused on "entrepreneurship." It's the classic version of college as education for its own sake. If you want to start a startup after college, what you should do in college is learn powerful things. And if you have genuine intellectual curiosity, that's what you'll naturally tend to do if you just follow your own inclinations.

The component of entrepreneurship that really matters is domain expertise. The way to become Larry Page was to become an expert on search. And the way to become an expert on search was to be driven by genuine curiosity, not some ulterior motive.

At its best, starting a startup is merely an ulterior motive for curiosity. And you'll do it best if you introduce the ulterior motive toward the end of the process.

It’s good to be a generalist but even better to be a polymath.

LEONARDO DA VINCI

INVENTIONS AND DISCOVERIES THAT CHANGED THE WORLD

SCISSORS

PARACHUTE

MONA LISA

ANATOMY STUDIES

ENGINEERING

Leonardo da Vinci was the ultimate polymath. His areas of interest included invention, drawing, painting, sculpture, architecture, science, music, mathematics, engineering, literature, anatomy, geology, astronomy, botany, paleontology, and cartography (Wikipedia). He had notebooks he regularly carried with him ("hanging from his belt"), taking notes of anything that amused him. In Toby Lester's book "Da Vinci's Ghost," the author writes that "whenever something caught [Da Vinci's] eye," he would begin "sketching furiously."

If you want to get into the startup world you should learn about a lot of different things. Practice noticing problems, things that seem inefficient, and major technological shifts. Work on projects you find interesting. Go out of your way to hang around smart, interesting people.

Don’t let schooling interfere with your education.

MARK TWAIN

At some point, ideas will emerge but only start a startup if you feel compelled about a particular problem and if you think that starting a company is the best way to solve it. Passion comes first. Find your zone by doing what you love.

We encourage you to take a deep look at what makes you tick and find, or even better, create a career doing exactly that.

It will give your career more longevity and you’ll be happier.

THE END.

LECTURE 8 CASE STUDY 1 | COMPETITION

GOOGLE VS YAHOO

FIRST OR LATE

First Mover versus Late Mover Advantage?

In the early days of the Internet, search engines like Lycos, Excite, AskJeeves, and others competed for pieces of the pie. By the end of the 20th century, however, Yahoo! (NASDAQ: YHOO) emerged as the leader, surviving the dot-com bubble that dragged the smaller companies under. Yahoo! then purchased most of these for next to nothing. In 2000, the site had 56% of search engine referrals, six times times its closest competitor.

Google had roughly 1% of the market in June of that year. In 2001, Yahoo! began using Google’s search algorithm. And as Google began competing for share, Yahoo! began to quickly lose steam. By 2002, the popularity of Google’s efficient engine had grown exponentially. It referred 31.8% of all searches, compared to Yahoo!’s 36.3%. During the the next eight years, Google rocketed to the top, gaining a near-monopoly on the market. According to Comscore, Currently, Google had more than 65% of market share, while its closest competitor, still Yahoo!, had just 16.1%.

LECTURE 8 CASE STUDY 2 | COMPETITION

INSOLAR

FOR A CLEANER PLANET

When it comes to Insolar, we’ve followed the competition rule book to a T. We’re in a small but growing market susceptible to monopolization and we compete with no one. We’re financially healthy and operate 1000 times more efficiently than all the other players in a peculiar industry that see more and more solar companies turning up insolvent everyday.

NO COMPETE CLAUSE

At Insolar we don’t compete with anybody. At this stage in the game; we’re just playing ball. We’ve already done all our of homework and are focused on executing our game plan. 0% of that has to do with what other companies are doing. We’re aware of them and their capabilities but that’s as far as it goes.

MONOPOLIZE-ABLE

Insolar is only 18 months old but there are traces of a monopoly living in the startup’s DNA. We’ve create something that’s an order of magnitude better than the next big thing; what our technology does hasn’t been done yet.

BIG FIGH, SMALL (BUT GROWING) POND

We’re going after a niche portion of the solar market, a market that is expected to double in the next five years.

LECTURE 8 CASE STUDY 3 | FUNDRAISING

CLICK TO OPEN UP STARTUP’S PITCH DECK

LECTURE 8 TASKS

TASK 1 | MONEY

Create a plan on how you’re going to finance your venture; if it involves raising money from investors you better learn how to play the game.

Complete the following docs:

INSOLAR, just like the all idea lab startups are financed through Round Z, the private investment arm of Forkaia.

These were the docs used to raise money for INSOLAR.

TASK 2 | RISK

Make a list of all the risks you think your startup is at risk of.

Write your plan to counter each risk?